Dow Jones Plunges Amid Rising U.S.-China Trade Tensions and Economic Uncertainty

Dow Jones Declines Amid Escalating Trade Tensions and Economic Concerns

On April 4, 2025, the Dow Jones Industrial Average (DJIA) experienced a dramatic drop, plunging over 1,900 points, or approximately 4.7%, closing at 40,545.93. This sharp decline was fueled by escalating trade tensions between the United States and China, which significantly impacted investor sentiment, causing a wave of selling across major stock indices.

The Catalyst: Trump’s Tariffs and China’s Retaliation

The immediate catalyst for the market downturn was President Donald Trump’s announcement of new tariffs on Chinese imports, which were seen as a continuation of his aggressive trade policies. In response, China quickly retaliated with its own set of tariffs, including a significant 34% tariff on all U.S. goods. This tit-for-tat escalation heightened fears of a protracted trade war, with investors fearing significant disruption to global trade and economic stability.

Impact on the Stock Market

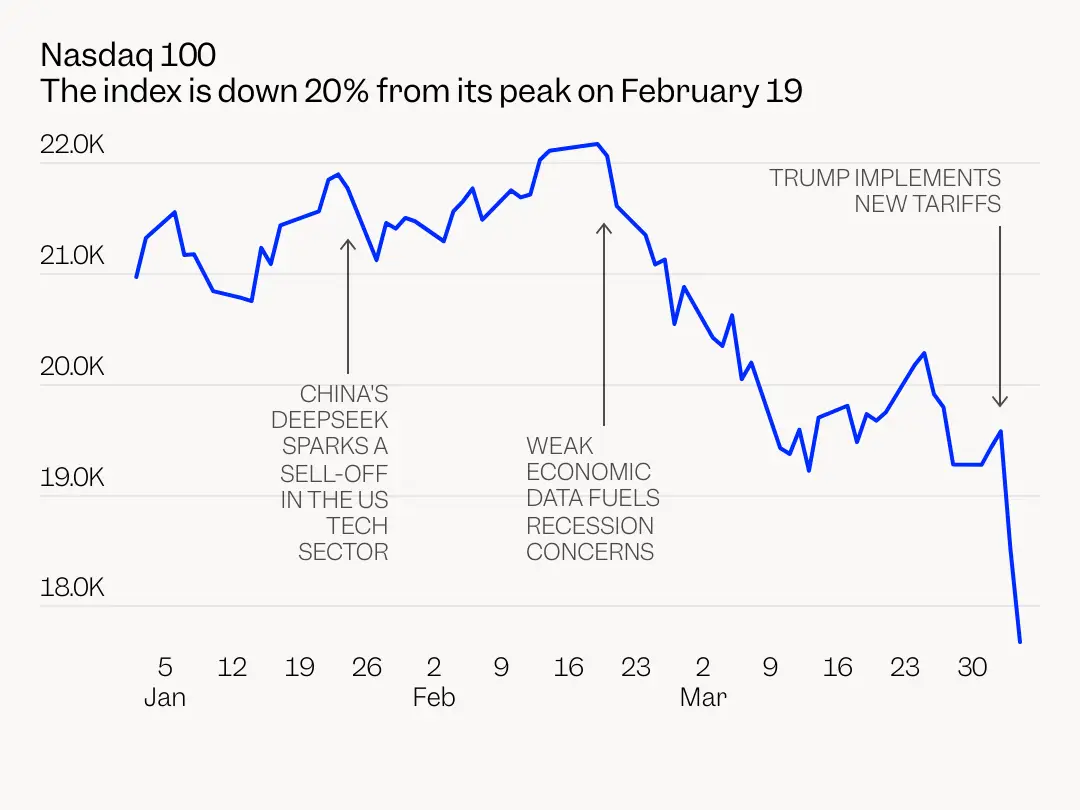

The Dow Jones was not alone in facing massive losses. The Nasdaq Composite entered bear market territory, defined by a drop of over 20% from its most recent peak. Similarly, the S&P 500 suffered substantial declines, marking its worst single-day performance since June 2020.

Among the hardest-hit sectors were technology and manufacturing stocks, with major players like Boeing and NVIDIA Corp. leading the losses. These companies, particularly vulnerable to international trade disruptions, saw sharp declines in their stock prices, contributing heavily to the overall market downturn.

Economic Concerns and Market Sentiment

Investors’ concerns were further exacerbated by comments from Federal Reserve Chair Jerome Powell, who indicated that the Federal Reserve was in no rush to cut interest rates. This cautious stance came at a time when many were hoping for more aggressive monetary easing to combat the economic fallout from the escalating trade war. Powell’s remarks added to the growing unease, as investors feared that the U.S. economy could face a prolonged slowdown.

Global Economic Impact

The market rout on April 4th also raised fears of a global economic slowdown. With both the U.S. and China deeply interconnected in the global supply chain, the continuing escalation of tariffs is likely to disrupt not only U.S.-China trade but also the broader global economy. Analysts have raised the probability of a global recession to 60%, fearing that trade tensions and the resulting economic uncertainties will significantly hamper growth prospects.

Investor Response:

In the face of these developments, investors sought safety in gold and U.S. Treasury bonds, pushing prices for these assets higher as they moved away from riskier equities. The volatility across markets highlighted the fragile nature of global trade relations and the sensitivity of stock markets to geopolitical risks.

What’s Next for the Markets?

As trade tensions between the U.S. and China continue to escalate, the outlook for the stock market remains uncertain. Analysts predict that further market fluctuations are likely, with heightened volatility expected in the short term. While the U.S. stock market is showing resilience, the impact of trade wars and economic uncertainty could cause continued pressure on stock prices in the coming months.

For now, all eyes will remain on the ongoing developments between the U.S. and China, and whether any diplomatic efforts can ease the mounting tensions. Until then, the market remains on edge, with investors bracing for more turbulence in the face of an unpredictable global economic landscape.

Conclusion

The sharp decline in the Dow Jones on April 4th underscores the profound impact of geopolitical events on financial markets. With the escalating trade war between the U.S. and China casting a long shadow over the global economy, the market is expected to remain volatile, with investors closely monitoring any signs of de-escalation or further tension. As we move forward, the future of the stock market remains uncertain, dependent on the resolution—or further escalation—of trade disputes between the world’s two largest economies.

Visitor comments ( 0 )