Buying a Car vs Leasing: Which Saves You More Money?

🚗 Buying a Car vs Leasing: Which Saves You More Money?

Introduction

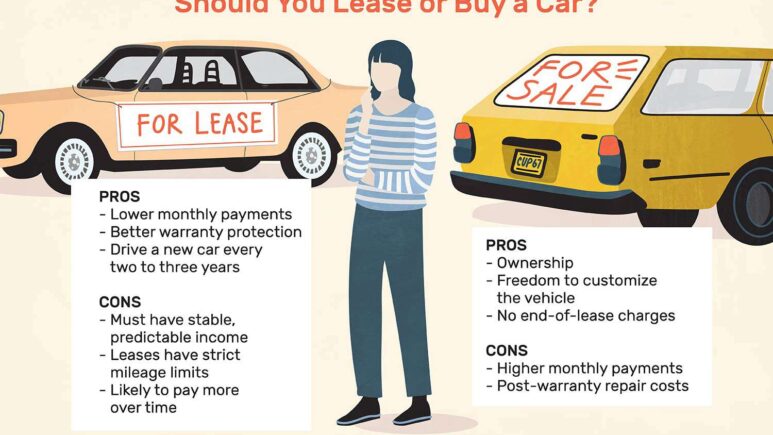

When it comes to getting a new vehicle, one of the biggest financial decisions you’ll face is whether to buy or lease. Each option has its advantages and costs, and understanding the differences can help you choose the most money-saving path based on your lifestyle and financial goals.

In this article, we’ll break down the pros and cons of buying vs leasing a car and reveal which option could save you more money.

Buying a Car: What You Need to Know

Pros of Buying

- Ownership: Once paid off, the car is yours, and you can keep it as long as you want.

- No Mileage Limits: Drive as much as you like without penalties.

- Customization: You can modify or customize your car.

- Long-Term Savings: Over time, buying tends to be cheaper if you keep your car for many years.

- Resale Value: You can sell or trade the car whenever you want.

Cons of Buying

- Higher Monthly Payments: Loans usually mean bigger monthly payments compared to leasing.

- Depreciation: Your car loses value quickly, especially in the first few years.

- Maintenance Costs: After warranty expiration, you bear all repair costs.

Leasing a Car: What You Need to Know

Pros of Leasing

- Lower Monthly Payments: Leasing generally costs less per month than financing a purchase.

- Newer Cars More Often: You can drive a new car every few years.

- Warranty Coverage: Leased cars are usually under warranty, so repairs are minimal.

- Lower Upfront Costs: Often requires less money down.

Cons of Leasing

- No Ownership: At the end of the lease, you return the car and own nothing.

- Mileage Restrictions: Most leases limit annual miles; exceeding them can be costly.

- Customization Limits: You can’t modify the car.

- Potential Extra Fees: Wear and tear or early termination fees can add up.

Which Saves You More Money?

Short-Term Perspective

Leasing typically saves money on monthly payments and upfront costs, making it attractive if you want lower immediate expenses or prefer changing cars frequently.

Long-Term Perspective

Buying a car usually saves more money over time since you eventually pay off the loan and own an asset. Keeping the car for several years reduces the overall cost per year significantly.

Factors That Affect Savings

- How long you plan to keep the car

- Annual mileage

- Maintenance and repair costs

- Interest rates on loans

- Lease terms and fees

Tips to Maximize Savings

- If buying, negotiate the purchase price and loan terms.

- If leasing, choose mileage limits that fit your driving habits.

- Consider certified pre-owned cars as a middle ground.

- Always read the fine print for lease agreements.

- Factor in insurance costs, which can vary between buying and leasing.

Conclusion

If you want lower monthly payments and a new car every few years, leasing might save you more money in the short run. However, if your goal is long-term savings and ownership, buying is generally the better financial choice.

Evaluate your personal needs, budget, and driving habits before deciding. Either way, informed decisions lead to smarter spending and better financial health.

SEO Keywords

- buying vs leasing a car

- which saves more money buying or leasing

- car leasing pros and cons

- car buying financial tips

- lease or buy a car 2025

Visitor comments ( 0 )